Benefits & Services

Precision Benefits Group incorporates consumerism into healthcare. We maintain objective, solid relationships with virtually all of the industry’s leading health insurance carriers. This is especially important when evaluating all the available options to create a customized solution for each client.

Employer Plans

No matter what size group you are, we are ready to assist you in every step of the way to finding your desired coverage. We provide some or all of the following benefits depending on your organization’s needs:

Individual Benefits

We offer a variety of individual products that will satisfy your coverage needs. PBG will advocate for you while finding you the lowest rates. We are able to provide:

Executive Benefits

Rely on PBG to provide benefits needed for your executive team. Executives typically require higher level of insurance needs than the standard employee. Employers also may want to provide their key employees with additional insurance benefits that provide value as well as improve retention. This may be in the form of additional life insurance, disability, and/or medical.

Buy-Sell Disability & Life Plans

A company is often owned by more than one person. This presents an additional layer of risk in the event one of the owners has a premature death or long-term disability. A buy-sell agreement backed by insurance policies solidifies proper transfer of ownership should an event like this happen. Let the experts at Precision Benefits Group guide you to the policies that best fit the needs of you and your partners.

What are the steps?

PEO

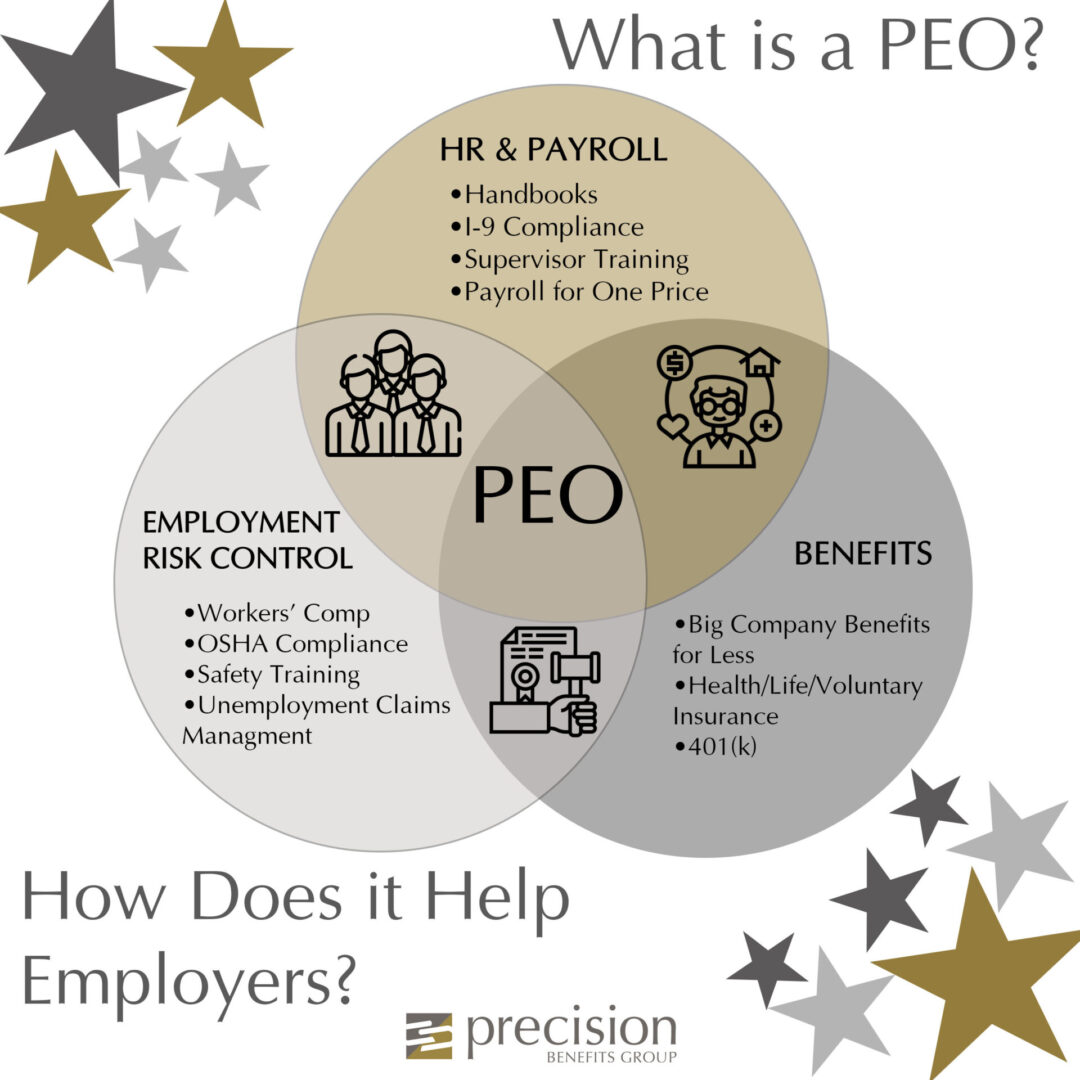

What is a PEO?

Professional Employer Organizations (PEOs) provide comprehensive HR solution to small and mid-size businesses.

Payroll, business insurance, employee benefits, human resource outsourcing, tax administration, and regulatory compliance assistance are some of the many services PEOs offer to growing businesses. All these services are usually wrapped into one automated online enrollment system that reduces time and paper.

Why use a PEO?

PEOs provide payroll, benefits, HR services and assistance with compliance issues under state and federal law that allow businesses to focus on their core mission that leads to improved productivity, profitability, and overall growth.

PEOs for Small Businesses

For small businesses, PEOs can allow employees to gain access to big-business employee benefits such as: 401(k) plans; health, dental, life, and other insurance; dependent care; and other benefits they might not typically receive as employees of a small company.

They reduce the need to hire new employees or task current employees to handle most of the in house work associated with running and maintaining these plans.

Benefit Analysis

No matter the size of your organization or employee benefit needs, our consultants will perform a strategic analysis to ensure you have the best programs and products at the lowest cost. Email or call us today to speak with an expert.